Home / Contents / Donations / News / Contact

PA - Portfolio Approach

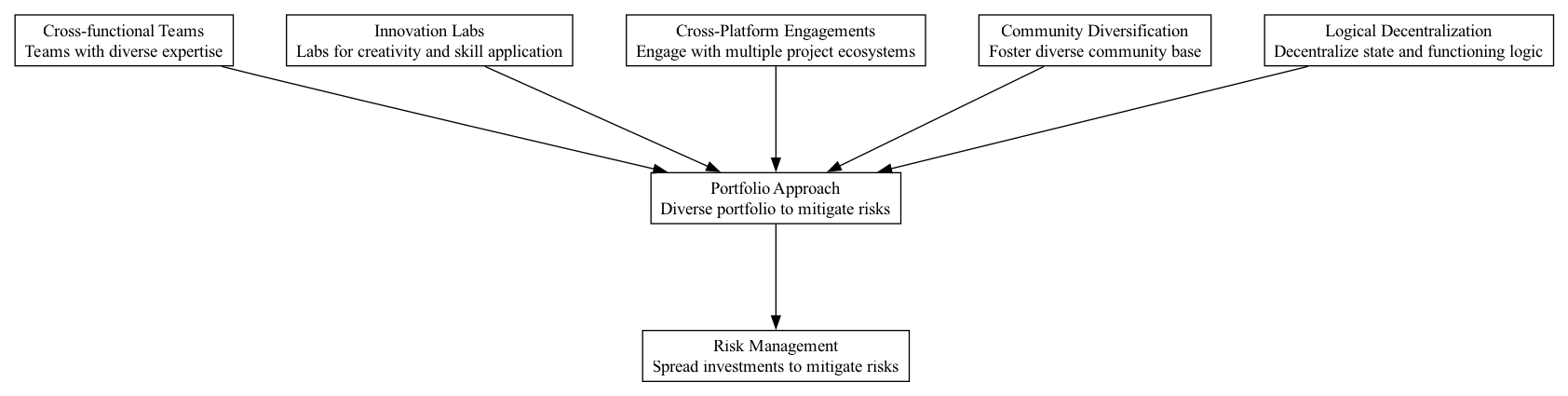

Supports:

Context:

In the dynamic and decentralized nature of DAOs, capital deployment is vital and challenging. Efficient allocation and risk management remain pivotal for sustainable growth. DAOs often engage in diverse initiatives ranging from code bounties to large-scale investments, requiring a balance to mitigate risk while maximizing impact and returns.

Problem:

DAOs face the dual challenge of resource allocation and risk management. Over-investment in single projects or sectors can lead to high exposure, while diverse but unfocused investment can dilute impact and waste resources.

Forces:

- Diversification vs. Focus: Balancing between spreading resources too thin and putting too many eggs in one basket.

- Dynamic Environments: The fast-paced evolution of technology and market conditions that DAOs operate within.

- Stakeholder Expectations: Different stakeholders may have varied expectations regarding risk tolerance and investment returns.

Solution:

Implement a portfolio approach to manage investments and projects. This involves categorizing projects and investments into various classes with differing risk profiles and potential returns. The portfolio is managed dynamically to optimize the overall risk-return ratio. Regular reviews and rebalancing are conducted based on performance metrics and strategic objectives. The approach leverages diversified involvement across different sectors and project types to stabilize returns and minimize risks related to any single venture or market fluctuation.

Examples and Case Studies:

- The Ethereum Foundation employs a similar approach by funding a range of projects from core protocol developments (low risk/essential) to high-risk, innovative projects through their grants program.

- MakerDAO maintains a diverse portfolio of collateral assets to stabilize DAI and manage risks effectively, thus supporting stability and growth in the volatile crypto market.

Therefore:

Adopt a portfolio management approach, categorizing projects and investments to balance risk and focus resources effectively. Regularly review and adjust the portfolio based on performance and strategic shifts.

Supported By:

- Cross-functional Teams

- Innovation Labs

- Community Diversification

- Cross-Platform Engagements

- Logical Decentralization