Home / Contents / Donations / News / Contact

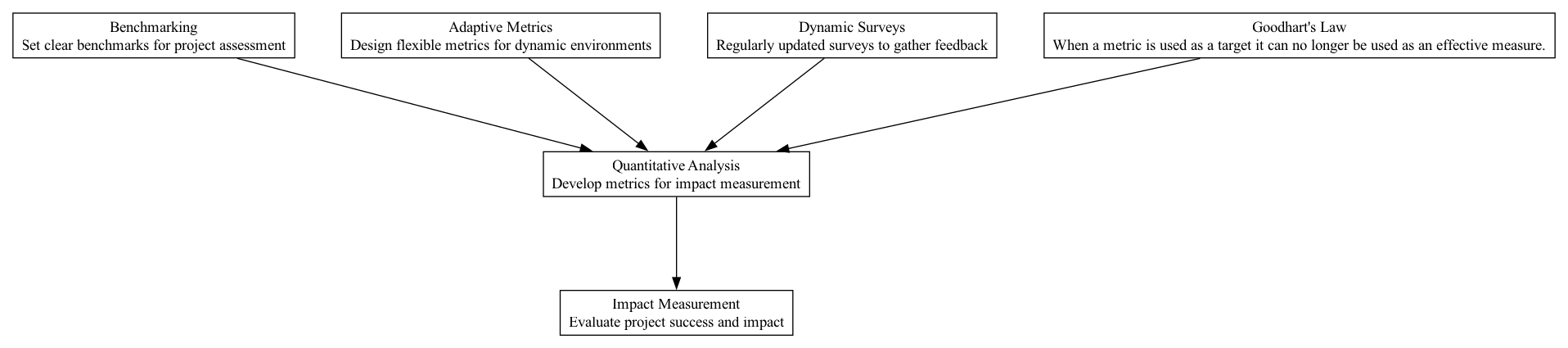

QAN - Quantitative Analysis

Supports:

Context:

In a DAO, making informed decisions on capital deployment—whether through bounties, grants, or investments—is pivotal. Such decisions must rely on a clear, empirical understanding of past outcomes and predictive insights into future potentials.

Problem:

DAOs often face challenges in systematically measuring and understanding the impact of their financial activities. Without robust methods to quantify the effectiveness of deployed capital, decision-making can become speculative and misaligned with the organization’s objectives.

Forces:

- Transparency vs. Complexity: While transparency in operations and decisions is crucial, the complexity of quantitative data can impede understanding and accessibility for all members.

- Precision vs. Generalization: The need for precise data collection that accurately reflects outcomes without being overly burdensome or generalized to the point of irrelevance.

- Dynamic vs. Static Metrics: Balancing between static metrics that provide consistency and dynamic metrics that adapt to changing conditions and provide relevant insights.

- Scalability: Tools and processes must scale with the growth of the DAO without losing accuracy or becoming financially unsustainable.

Solution:

Implement a structured system for continuous quantitative analysis. This involves developing specific metrics that can be uniformly applied, such as transaction volumes for trading platforms or active users for applications. Utilize blockchain technology to automate data capture, ensuring accuracy and minimizing manual errors. Data should be processed using statistical tools to identify trends, correlations, and causations, supporting strategic decisions about where and how to allocate resources.

For instance, MakerDAO uses metrics like Total Value Locked (TVL) and Collateralization Ratios to make informed decisions about managing its crypto-economic policies. Similarly, DAOs like Dash deploy treasury analytics to measure the impact of funded projects on overall network performance, adjusting funding allocations based on these insights.

Therefore:

Adopt quantitative analysis with clear, consistent metrics and automated data collection tools to enhance decision-making in DAOs, ensuring capital is deployed efficiently and effectively based on empirical evidence.

Supported By: