Home / Contents / Donations / News / Contact

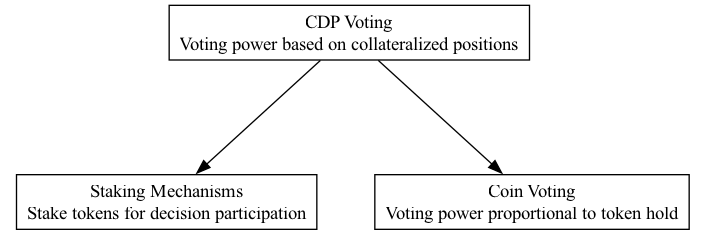

CDP - CDP Voting

Supports:

Context:

In the context of DAOs, particularly those operating within decentralized finance (DeFi), the allocation of voting rights is often correlated with the economic stake and risk exposure participants have within the platform. This is typically represented by the tokens or assets they hold. CDP (Collateralized Debt Position) Voting refers to the mechanism where voting rights are assigned based on collateralized positions held within the system.

Problem:

The problem arises when CDPs can be adjusted in such a way that participants can amplify their voting power without a corresponding increase in actual economic risk or long-term commitment. This can lead to governance attacks or manipulation, as actors could significantly influence decisions without a true stake.

Forces:

- Governance Integrity: The need for reliable and fair decision-making processes.

- Economic Alignment: Ensuring that those who have more at stake have proportionate influence in decision-making.

- System Stability: Preventing the destabilization of governance through manipulative practices.

Solution:

Implementing a mechanism within DAOs that mandates a lock-up period for tokens used as collateral in CDPs when they are utilized to gain voting rights. This time-lock should be of sufficient length to mitigate the risk of quick in-and-out tactics that can lead to governance manipulation. The lock-up period aligns the voter’s interests with the long-term health and stability of the DAO by ensuring that they cannot remove their stake immediately after influencing decisions that could have long-lasting implications.

Therefore:

To maintain integrity and stability in DAO governance, a time-lock mechanism should be integrated for any CDP used in voting processes ensuring participants’ interests are aligned with the long-term goals and health of the DAO.