Home / Contents / Donations / News / Contact

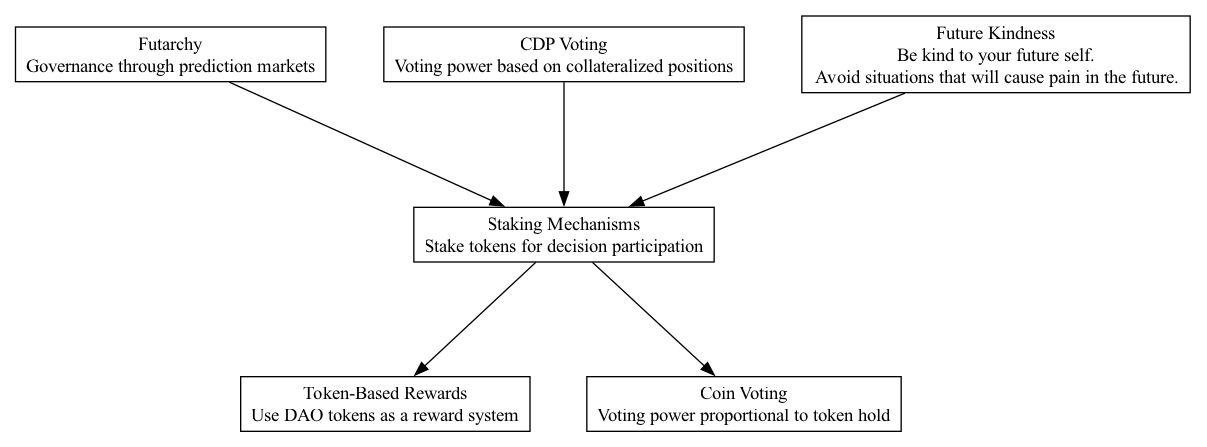

STM - Staking Mechanisms

Supports:

Context:

In DAOs, ensuring committed and responsible participation is crucial, particularly when decisions impact the allocation and management of substantial capital. Staking mechanisms serve to align participant incentives with the long-term success and health of the ecosystem.

Problem:

Without a staking mechanism, participants might engage in decision-making that promotes short-term gains at the expense of long-term stability and growth, potentially leading to suboptimal outcomes and reduced trust among members.

Forces:

- Commitment vs. Speculation: Balancing the need for active, long-term participant engagement against short-term speculative behavior.

- Risk vs. Reward: Participants must feel that the risks taken by staking tokens are aptly rewarded.

- Decentralization vs. Security: Ensuring the DAO remains decentralized while protecting it from malicious actors or uninformed decision-making.

Solution:

Implement a staking mechanism where participants are required to lock up tokens to engage in voting or decision-making processes. This lock-up period should be extensive enough to discourage short-term speculation and ensure that only those who are genuinely invested in the DAO’s future have a say in critical decisions. The staked tokens could also earn rewards, aligning further with the DAO’s success.

Real-world examples include:

- Ether2.0: Where participants stake Ether to become validators, playing a role in network security and governance, thereby incentivizing long-term holding and participation.

- Internet Computer: Uses staking in governance decisions where longer staking durations increase voting power, encouraging more thoughtful long-term decision-making amongst token holders.

Therefore:

Integrate staking mechanisms within DAO operations to ensure that voting power and participation rights are aligned with long-term incentive structures, fostering greater responsibility and reducing speculative behavior.

Supported By: